Table of Contents

Why Orthopedic Surgery Insurance Matters More Than Ever

Orthopedic conditions are rising rapidly in India. Over 2.5 lakh individuals undergo knee replacement surgery annually, and that’s just one procedure. With treatment costs ranging from ₹50,000 to ₹3.5 lakhs for common surgeries, having the right health insurance is no longer optional-it’s essential.

As an orthopedic surgeon, I’ve seen countless patients delay necessary treatments due to financial concerns. Joint replacement surgery can cost several lakhs, with additional expenses for MRIs, X-rays, and specialist consultations adding to the burden. This guide will help you choose insurance that protects both your health and your finances.

What Does Health Insurance Cover for Orthopedic Surgery?

Before diving into the top insurance providers, let’s understand what’s typically covered:

Covered Orthopedic Procedures:

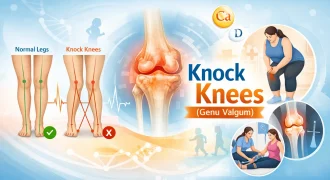

- Joint Replacement Surgeries: Knee, hip, and shoulder replacements

- Trauma Management: Fracture fixation, emergency surgeries

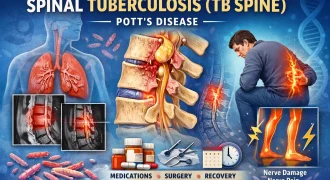

- Spine Surgeries: Spinal fusion, disc replacement, laminectomy

- Sports Injuries: ACL/PCL reconstruction, meniscus repair, rotator cuff surgery

- Arthroscopic Procedures: Minimally invasive joint surgeries

- Ligament and Tendon Repairs: Comprehensive soft tissue procedures

What’s Included in Your Coverage:

- Pre-hospitalization expenses (diagnostic tests, consultations, imaging)

- Hospitalization costs (room rent, surgeon fees, anesthesia, nursing)

- Surgical implants and prosthetics (plates, screws, artificial joints)

- Post-hospitalization care (physiotherapy, follow-up visits, medications)

- Ambulance charges for emergency transfers

- Day-care procedures (arthroscopy, minor repairs)

Understanding Waiting Periods: Critical Information

This is crucial-don’t skip this section:

Accidental injuries: Covered from Day 1 (no waiting period)

Planned surgeries (joint replacements, arthritis treatments): 1-2 years

Pre-existing conditions: 2-4 years (varies by insurer)

Day-care procedures: Often, no waiting period

Pro Tip from Dr. Ahuja: If you’re experiencing joint pain or know surgery might be necessary, purchase insurance immediately. The waiting period clock starts ticking only after you buy the policy.

⏰ Waiting Period Tracker

Track when your orthopedic procedures will be covered (approx.)

Enter Your Policy Details

💡 Tip: Government schemes often have zero waiting periods; accidental injuries are covered from Day 1. Use the tracker to estimate when each treatment becomes claimable.

Your Coverage Timeline

Waiting Period Comparison Across Insurers

| Condition | Standard | Premium | Government |

|---|---|---|---|

| Accidental Injury | Day 1 | Day 1 | Day 1 |

| General Conditions | 30 days | 30 days | No wait |

| Joint Replacement | 2 years | 1 year | No wait |

| Pre-existing | 3 years | 2 years | No wait |

Need Help with Insurance or Treatment?

Dr. Divya Ahuja’s clinic helps with documentation, pre-auth, and claims guidance.

Schedule ConsultationTop 5 Health Insurance Companies for Orthopedic Coverage

1. Star Health and Allied Insurance

Why Star Health Leads for Orthopedic Patients

Star Health is India’s only standalone health insurance provider offering inbuilt maternity benefits, covering 17 crore customers with comprehensive health insurance plans. Their specialization in health insurance translates to a better understanding of orthopedic needs.

Key Performance Metrics:

- Claim Settlement Ratio: 92.02% (March 2025)

- Network Hospitals: 14,000+ across India

- Solvency Ratio: 2.21 (financially strong)

- Market Position: Largest standalone health insurer in India

Flagship Plans for Orthopedic Coverage:

Family Health Optima Insurance Plan

- Covers up to 6 adults and 3 children under one policy

- Comprehensive joint surgery coverage

- No sub-limits on orthopedic procedures

- Annual health check-ups included

- Lifetime renewability option

Senior Citizen Red Carpet Plan

- Specifically designed for elderly patients needing joint replacements

- Pre-existing condition coverage after waiting period

- Domiciliary hospitalization for at-home recovery

Orthopedic-Specific Advantages:

✓ In-house claim settlement team (faster processing)

✓ Cashless treatment at specialized orthopedic hospitals

✓ Coverage for AYUSH treatments alongside modern procedures

✓ No age limit for policy entry (elderly patients can get covered)

Best For:

Families with elderly members, patients requiring comprehensive joint surgery coverage, and those seeking specialized orthopedic hospital networks

2. HDFC ERGO Health Insurance

Premium Coverage with High Success Rates

HDFC ERGO, a joint venture between India’s largest private bank and ERGO International AG, maintains an exceptional claim settlement ratio of 99.16% as of March 2025. This near-perfect settlement rate makes them highly reliable for expensive orthopedic procedures.

Key Performance Metrics:

- Claim Settlement Ratio: 99.16% (industry-leading)

- Network Hospitals: 12,000+, including premier orthopedic centers

- Sum Insured Options: Up to ₹2 crore

- Digital Excellence: User-friendly app for claims and policy management

Premium Plans for Orthopedic Surgery:

Optima Secure Plan

- Instant 2X coverage boost

- No room rent limits (crucial for extended orthopedic stays)

- Consumables covered (bandages, surgical supplies)

- Coverage increases annually regardless of claims

Optima Secure Global

- All Optima Secure benefits PLUS international coverage

- Up to ₹2 crore coverage limit

- Ideal for complex procedures requiring overseas treatment

Health Companion

- Inflation-adjusted coverage

- Direct claims processing without TPA delays

Orthopedic-Specific Benefits:

- Zero waiting period for accidental fractures and trauma

- Coverage for robotic-assisted orthopedic surgeries

- Pre and post-hospitalization covered for 60-180 days

- Advanced spine and joint procedures are fully covered

- Physiotherapy and rehabilitation expenses included

Cost Factor:

Knee replacement surgery costs range from ₹2 to ₹3 lakhs in India. HDFC ERGO’s high coverage limits ensure complete financial protection.

Best For:

Professionals seeking premium coverage, patients requiring complex orthopedic procedures, and those wanting international treatment options

3. Niva Bupa Health Insurance (Formerly Max Bupa)

Speed and Innovation in Orthopedic Claims

Niva Bupa Health Insurance is recognized as India’s Best Health Insurer by Mint for 2024, with the ability to initiate claims and start processing within 30 minutes. This rapid response is critical for trauma patients needing emergency orthopedic surgery.

Key Performance Metrics:

- Claim Settlement Ratio: 92.77%

- Network Hospitals: 10,000+, including specialized orthopedic centers

- International Coverage: 190+ countries

- Affordability: Plans starting at ₹20 per day

Top Plans for Orthopedic Patients:

ReAssure 2.0

- Best-selling plan in India

- Comprehensive orthopedic surgery coverage

- Wellness benefits and preventive care

- Modern treatment coverage, including new surgical techniques

Senior First (Platinum)

- Specialized for elderly patients requiring joint replacements

- Reduced waiting periods

- Coverage for age-related orthopedic conditions

Health Premia

- High-value coverage for complex surgeries

- Premium surgical implant coverage

Unique Orthopedic Advantages:

- 30-minute claim initiation (fastest in industry)

- Ambulance charges covered (critical for trauma cases)

- Organ donor expenses (relevant for bone grafting procedures)

- Day-care procedure coverage for arthroscopy

- Telemedicine for post-surgery consultations

- No TPA involvement in in-house claim processing

Why Speed Matters:

In trauma cases, every minute counts. Orthopedic surgeries can cost several lakhs, making quick claim approval essential. Niva Bupa’s rapid processing ensures you can proceed with surgery without financial delays.

Best For:

Working professionals, trauma patients requiring emergency surgery, families wanting rapid claim settlement, and elderly patients needing joint replacements

4. ICICI Lombard Health Insurance

Technology Meets Comprehensive Coverage

ICICI Lombard combines robust financial backing with cutting-edge digital solutions, making policy management seamless for orthopedic patients requiring multiple consultations and treatments.

Key Performance Metrics:

- Claim Settlement Ratio: 97.16%

- Network Hospitals: 6,500+ nationwide

- Digital Innovation: Award-winning mobile app

- Customer Support: 24/7 emergency claim assistance

Comprehensive Plans:

MaxProtect Premium

- Coverage up to ₹1 crore

- Comprehensive orthopedic surgery benefits

- Advanced treatment coverage

- Family floater options

Complete Health Insurance

- Affordable base coverage

- Essential orthopedic procedures covered

- Suitable for young families

Orthopedic-Specific Features:

- Coverage for robotic-assisted joint replacement surgeries

- At-home treatment coverage (domiciliary hospitalization)

- Physiotherapy and rehabilitation post-surgery

- Advanced imaging (MRI, CT scans) is fully covered

- Wellness programs with doctor consultations

- Digital claim tracking through a mobile app

Technology Advantage:

Track your claim status in real-time, upload documents digitally, and schedule video consultations with doctors from the ICICI Lombard app. This is particularly helpful during post-surgery recovery when mobility is limited.

Best For:

Tech-savvy individuals, urban professionals, patients requiring multiple consultations, and those preferring digital policy management

5. Care Health Insurance (Formerly Religare)

Specialized Plans for Complex Orthopedic Needs

Care Health Insurance offers innovative health plans with extensive coverage for advanced orthopedic treatments, including cutting-edge procedures that many insurers exclude.

Key Performance Metrics:

- Claim Settlement Ratio: 92.77%

- Network Hospitals: 24,800+ healthcare providers

- Claim Approval: Within 2 hours at cashless hospitals

- Coverage Range: Plans from basic to super-premium

Comprehensive Plans:

Care Supreme

- High-value coverage with unlimited restoration benefit

- Advanced orthopedic procedure coverage

- No age limit for entry

- Comprehensive illness coverage

Care Individual Health Plan specifically covers Total Knee Replacement treatment with an adequate sum insured to prevent financial difficulties

Care Freedom

- Senior citizen specialized plans

- Pre-existing condition coverage

- Age-related orthopedic conditions covered

Revolutionary Orthopedic Coverage:

- Robotic surgery coverage (the most advanced joint replacement technique)

- Stem cell therapy for orthopedic conditions

- Bone grafting and reconstruction procedures

- Complex fracture management with the latest implants

- Polytrauma critical care coverage

- Annual preventive health check-ups

- In-house claim settlement (no TPA delays)

What Makes Care Health Special:

Coverage includes hospitalization, surgical costs, pre- and post-operative care, rehabilitation, and medical devices like braces or implants. Their comprehensive approach ensures every aspect of orthopedic treatment is covered.

Best For:

Patients requiring advanced robotic surgeries, those seeking innovative treatment options, individuals with complex orthopedic conditions, and senior citizens

Quick Comparison Table: Top 5 Insurers at a Glance

Health Insurance Comparison

| Feature | Star Health | HDFC ERGO | Niva Bupa | ICICI Lombard | Care Health |

|---|---|---|---|---|---|

| CSR | 92.02% | 99.16% | 92.77% | 97.16% | 92.77% |

| Network Hospitals | 14,000+ | 12,000+ | 10,000+ | 6,500+ | 24,800+ |

| Claim Speed | Standard | Fast | 30 minutes | Standard | 2 hours |

| Max Coverage | High | ₹2 crore | High | ₹1 crore | Very High |

| Special Feature | Standalone specialist | Highest CSR | Fastest claims | Digital excellence | Advanced treatments |

| Best For | Families | Premium coverage | Speed | Tech users | Complex cases |

🛡️ Insurance Comparison Tool

Find the right insurance for your orthopedic needs

🎯 Get Personalized Recommendation

Your Personalized Recommendations:

🏆 Based on Age Group:

🏥 Based on Surgery Type:

Select Insurers to Compare (up to 3)

Detailed Comparison

Need Expert Guidance?

Consult with Dr. Divya Ahuja for personalized orthopedic care and insurance navigation

Schedule ConsultationCost of Common Orthopedic Surgeries in India

Understanding typical costs helps you choose adequate coverage:

Joint Replacements:

- Knee Replacement (Single): ₹1.5 – ₹2.5 lakhs

- Hip Replacement: ₹2 – ₹3.5 lakhs

- Shoulder Replacement: ₹2 – ₹3 lakhs

Spine Surgeries:

- Spinal Fusion: ₹2.5 – ₹4 lakhs

- Disc Replacement: ₹3 – ₹5 lakhs

- Laminectomy: ₹1.5 – ₹2.5 lakhs

Sports Injuries:

- ACL Reconstruction: ₹1 – ₹2 lakhs

- Arthroscopic Surgery: ₹50,000 – ₹1.5 lakhs

- Rotator Cuff Repair: ₹1.5 – ₹2.5 lakhs

Additional Expenses to Consider:

- Pre-surgery diagnostic tests: ₹10,000 – ₹25,000

- Physiotherapy (3 months): ₹15,000 – ₹40,000

- Medications and follow-ups: ₹10,000 – ₹20,000

Recommended Coverage: Minimum ₹5 lakhs for individuals, ₹10 lakhs for families

Government Insurance Options for Orthopedic Surgery

Ayushman Bharat Yojana (PM-JAY)

The Ayushman Bharat scheme covers approximately 1,400 expensive procedures, including knee replacements and skull surgery, with no waiting periods.

Key Benefits:

- ₹5 lakhs coverage per family per year

- Zero waiting period for orthopedic surgeries

- Cashless treatment at empaneled hospitals

- Available for eligible families nationwide

CGHS, ECHS, DGHS Schemes

Government and semi-government employees (ONGC, NTPC, SAIL, IOCL, BHEL) are covered under schemes with zero waiting periods.

Advantages:

- Comprehensive orthopedic coverage

- No waiting period for any procedure

- Access to government and private hospitals

- Lifetime coverage for retirees

How to Choose the Right Insurance for Your Orthopedic Needs

Step 1: Assess Your Risk Factors

Consider:

- Age (joint issues increase after 50)

- Activity level (sports, physically demanding job)

- Family history of orthopedic conditions

- Current symptoms (joint pain, stiffness)

- Lifestyle factors (weight, posture, occupation)

Step 2: Evaluate Coverage Requirements

Essential Features to Look For:

Adequate Sum Insured

- Minimum ₹5 lakhs for individuals

- ₹10-15 lakhs for families

- ₹25 lakhs+ for comprehensive protection

High Claim Settlement Ratio

- Aim for 90%+ CSR

- Check settlement speed

- Read customer reviews

Extensive Hospital Network

- Verify specialized orthopedic hospitals in your city

- Check for super-specialty centers

- Confirm cashless facility availability

Comprehensive Coverage

- Pre and post-hospitalization duration (60-180 days)

- Physiotherapy coverage

- Implant and prosthetic coverage

- Day-care procedures included

- No sub-limits on orthopedic treatments

Reasonable Waiting Periods

- Shorter waiting periods are preferable

- Zero waiting for accidental injuries

- Reduced periods for pre-existing conditions

Step 3: Compare Premium vs. Benefits

Don’t Choose Based on Price Alone

Lower premium, ≠ Better value

Consider:

- Coverage comprehensiveness

- Network hospital quality

- Claim settlement track record

- Customer service ratings

- Hidden costs and sub-limits

Maximizing Your Insurance Benefits: Expert Tips

Before Surgery:

1. Verify Coverage Thoroughly

- Confirm your specific procedure is covered

- Check if your surgeon and hospital are in-network

- Understand any sub-limits or caps

2. Complete Waiting Periods

For knee surgeries and treatments, there is a specific waiting period of 24 months. Plan accordingly for non-emergency procedures.

3. Obtain Pre-Authorization

- Submit all required documents

- Get written approval before surgery

- Clarify any coverage questions

4. Choose Network Hospitals

- Opt for cashless treatment

- Reduces immediate financial burden

- Streamlines claim process

During Treatment:

1. Keep All Documentation

- Original bills and receipts

- Discharge summary

- Prescription records

- Diagnostic test reports

2. Inform Insurer Promptly

- For emergency surgeries: notify within 24 hours

- For planned procedures: pre-authorize 7-10 days before

3. Use Cashless Facility

- Minimize out-of-pocket expenses

- The hospital deals directly with the insurer

- You pay only non-covered expenses

Post-Surgery:

1. Claim Physiotherapy Expenses. Many patients don’t realize physiotherapy is covered. Submit all bills for:

- Physiotherapy sessions

- Rehabilitation equipment

- Follow-up consultations

2. Submit Claims Quickly

- File within policy-specified timeframe (usually 30 days)

- Include all supporting documents

- Follow up regularly on claim status

3. Keep Records for Tax Benefits

Health insurance premiums and medical expenses qualify for tax deductions under Section 80D.

Common Exclusions: What’s NOT Covered

Be Aware of These Limitations:

❌ Cosmetic orthopedic procedures (unless medically necessary)

❌ Self-inflicted injuries

❌ Treatment during waiting periods (for planned surgeries)

❌ Experimental or unproven treatments

❌ Pre-existing conditions not disclosed (claim rejection risk)

❌ Treatment outside network (reduced reimbursement or denial)

❌ Injuries from professional sports (unless specified)

❌ Adventure activity injuries (rock climbing, bungee jumping)

Always Read Policy Documents Carefully

Red Flags: When to Be Cautious

Warning Signs of Inadequate Coverage:

🚩 Unusually low premiums (often means limited coverage)

🚩 Very high co-payment requirements

🚩 Severe sub-limits on implants and prosthetics

🚩 Restricted network of low-quality hospitals

🚩 Poor customer reviews and complaints

🚩 Low claim settlement ratio (below 85%)

🚩 Hidden terms and conditions

🚩 No coverage for day-care procedures

Final Recommendations from Dr. Divya Ahuja

As an orthopedic surgeon with years of experience treating patients from all economic backgrounds, I’ve seen how the right insurance can be life-changing. Here’s my professional advice:

For Young Professionals (20-40 years):

Choose Niva Bupa or ICICI Lombard for digital convenience, rapid claims, and comprehensive coverage. Start with ₹5-10 lakh coverage.

For Families with Children:

Opt for Star Health Family Optima, covering multiple members under one policy. Consider ₹10-15 lakh coverage for complete protection.

For Senior Citizens (60+ years):

Select HDFC ERGO Optima Secure or Care Health Freedom plans designed for elderly patients. Ensure coverage for pre-existing conditions and joint replacements. Minimum ₹10 lakh coverage recommended.

For Athletes and Active Individuals:

Choose Care Health Supreme, covering sports injuries and advanced treatments like robotic surgery and stem cell therapy.

For Budget-Conscious Buyers:

Start with Star Health or basic plans from any top insurer, but ensure adequate sum insured. Remember: inadequate coverage is almost as risky as no coverage.

Universal Advice:

✓ Buy Early: Don’t wait for symptoms to appear. Waiting periods only start after purchase.

✓ Disclose Everything: Pre-existing conditions must be declared. Hidden conditions lead to claim rejection.

✓ Read Policy Documents: Understand what’s covered and what’s excluded.

✓ Maintain Health Records: Keep all medical documents organized for smooth claims.

✓ Review Annually: Reassess coverage needs and upgrade if necessary.

Why This Matters: A Doctor’s Perspective

In my practice at Dr. Divya Ahuja’s clinic, I encounter three types of patients:

Type 1: Those with comprehensive insurance who proceed confidently with necessary surgeries, achieving full recovery.

Type 2: Those with inadequate coverage who delay treatment, resulting in worsened conditions and higher eventual costs.

Type 3: Those without insurance who face financial devastation or forego treatment entirely.

Don’t be Type 2 or 3. Orthopedic conditions rarely improve without intervention. Joint degeneration worsens over time, simple fractures can develop complications, and delayed treatment often results in permanent disability.

The peace of mind that comes with comprehensive insurance is invaluable. When I recommend surgery, I want my patients focused on recovery, not worried about finances.

Take Action Today

Orthopedic emergencies don’t announce themselves. A simple fall, a sports injury, or gradual joint degeneration can require surgery at any time. Protect yourself and your family now.

Next Steps:

- Assess Your Needs: Consider age, lifestyle, and risk factors

- Research Options: Compare the top 5 insurers mentioned above

- Get Quotes: Request proposals from multiple companies

- Read Fine Print: Understand waiting periods and exclusions

- Purchase Coverage: Don’t delay-waiting periods start only after purchase

- Maintain Documentation: Keep all medical records organized

Conclusion

Choosing the right health insurance for orthopedic and trauma coverage is one of the most important financial decisions you’ll make. The five insurers highlighted in this guide-Star Health, HDFC ERGO, Niva Bupa, ICICI Lombard, and Care Health-represent the best options available in India for 2025.

Each offers unique advantages:

- Star Health for comprehensive family coverage

- HDFC ERGO for premium plans with the highest claim settlement

- Niva Bupa for the fastest claim processing

- ICICI Lombard for digital convenience

- Care Health for advanced treatment coverage

Remember, the best insurance is the one you buy before you need it. With orthopedic conditions affecting people of all ages, comprehensive coverage isn’t a luxury-it’s a necessity.

Invest in your health. Invest in your future. Choose wisely.

Disclaimer: This article provides general information about health insurance coverage for orthopedic surgeries in India. Policy terms, coverage details, waiting periods, premiums, and benefits vary significantly by insurer, specific plan, and individual circumstances. Always read policy documents carefully, compare multiple options, and consult with insurance advisors before purchasing. Information is current as of December 2025 and subject to change per IRDAI regulations. This content should not be considered as medical or insurance advice. Consult qualified professionals for personalized recommendations.

FAQs — Orthopedic & Trauma Surgery Insurance

Common questions about coverage, waiting periods, implants, physiotherapy, emergency trauma and portability.

Are orthopedic surgeries covered under health insurance in India?

Yes. Most comprehensive health insurance plans in India cover ACL, spinal, knee, hip and many other orthopedic surgeries. Typical coverage includes hospitalization, surgeon fees, implants and rehabilitation—but exact inclusions depend on the specific policy and plan terms.

What is the waiting period for joint replacement surgery?

Planned joint replacement and arthritis-related treatments typically have waiting periods of 1–2 years. However, surgeries required due to accidental injury are usually covered from Day 1 with no waiting period. Waiting periods vary by insurer and plan, so check your policy wording.

Does insurance cover knee replacement surgery fully?

Coverage depends on the policy and its age. Older/basic policies sometimes reimburse a portion (e.g., ~50%) while modern comprehensive plans can cover up to 100% of eligible expenses subject to sub-limits, co-payments and network rules. Always read the policy document and check implant/sub-limit clauses.

Are prosthetics and implants covered?

Yes, most insurers include coverage for surgical implants (artificial joints, plates, screws, nails) as part of the in-hospital surgical bill. However, some plans impose sub-limits or separate caps on implants—verify implant limits, branded-implant clauses and any co-pay before surgery.

Does insurance cover physiotherapy after orthopedic surgery?

Yes. Many comprehensive plans include post-hospitalization physiotherapy for a specified period (commonly 60–90 days). Coverage terms vary, so check limits, maximum number of sessions allowed and whether physiotherapy bills must be submitted in a particular format.

Can I use the Ayushman Bharat card for orthopedic surgery?

Yes. Ayushman Bharat (PM-JAY) covers a large list of expensive procedures—including many orthopedic surgeries such as knee replacements—offering cashless treatment at empanelled hospitals and typically with no waiting period for covered procedures. Eligibility is determined by the scheme criteria.

What if I need emergency trauma surgery?

Emergency orthopedic surgeries resulting from accidents are generally covered from Day 1 without waiting periods. Notify your insurer promptly (usually within 24 hours of admission) and follow the insurer’s claim-intimation procedure to ensure smooth cashless or reimbursement processing.

How do I know if my hospital is in the insurance network?

Check your insurer’s official website or mobile app for a searchable list of network/empanelled hospitals. You can also call the insurer’s customer support to confirm a hospital’s status—this is critical for cashless treatment at specialised orthopedic or super-speciality centres.

What happens if I’m diagnosed with an orthopedic condition before buying insurance?

A pre-existing orthopedic condition disclosed at the time of purchase is usually subjected to a waiting period (commonly 2–4 years) before related treatments are covered. Non-disclosure of such conditions risks claim rejection. Some insurers may offer immediate coverage for declared conditions at higher premiums—read terms carefully.

Can I port my health insurance to a better company?

Yes. IRDAI’s portability rules allow policyholders to switch insurers while retaining benefits such as elapsed waiting periods. Apply for portability 45–60 days before your policy renewal and follow the new insurer’s portability process to avoid loss of accrued waiting period benefits.